30+ mortgage deduction limitation

A partnership may elect to use the 30 ATI limitation instead of 50 for only taxable. Web If you can deduct all of the interest on your mortgage you may be able to deduct all of the points paid on the mortgage.

Standard Deduction Vs Itemized Deductions Britannica Money

If you do claim.

. Web The federal standard deduction is high enough that youre unlikely to claim the mortgage interest deduction unless you earn a significant income. Adopted this approach in 2017 as part of the Tax Cuts and Jobs Act TCJA. 163 h 2 and 3 limitations on a per -.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The IRS issued Action on Decision 2016 - 02 in August indicating it will follow the Ninth Circuits lead in applying the Secs. Web Most homeowners can deduct all of their mortgage interest.

Web The 50 ATI limitation does not apply to partnerships for taxable years beginning in 2019. Web The US. 31 2017 business interest expense deductions are limited to the sum of.

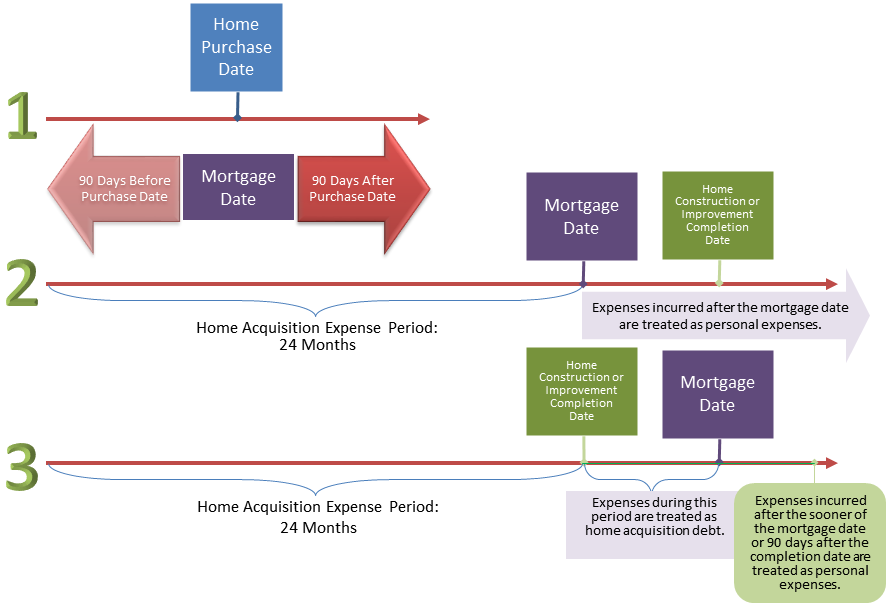

If your home acquisition debt exceeds the limit for your. That means that the mortgage interest you. The new section 163 j thin-capitalization rule limited the net interest deduction.

Between those two incomes you can deduct. Homeowners who bought houses before. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

The taxpayers business interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web mortgage interest deduction will pay higher taxes because the standard deduction and other changes enacted by TCJA may more than compensate for the loss of the.

Web Under Sec. Web Above 109000 54500 if married and filing separately you cant make any deductions for mortgage insurance. 163j for tax years beginning after Dec.

If You Care About Small Business Keep The Home Mortgage Interest Deduction Small Business Trends

Mortgage Interest Deduction How It Calculate Tax Savings

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

It S Time To Gut The Mortgage Interest Deduction

Mortgage Interest Deduction How It Calculate Tax Savings

World 12 27 17

I Ve Always Hated This R Antiwork

Limitations Of Mortgage Interest Deductibility A Limits On The Amounts Download Table

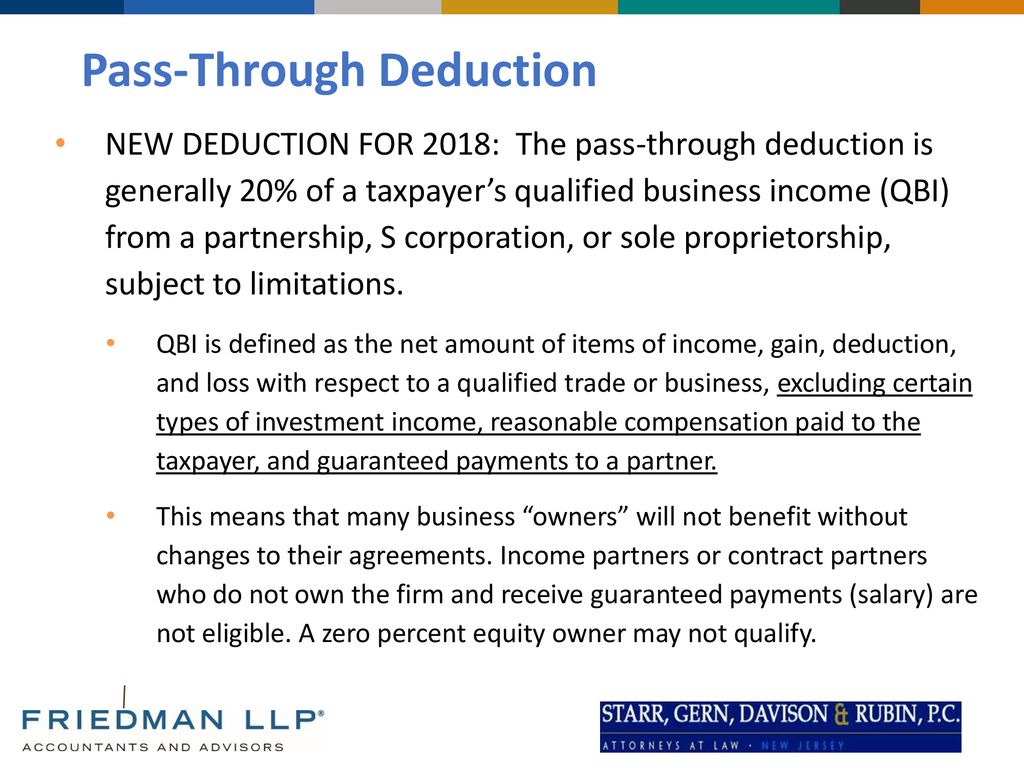

Susan Miano Cpa Avc Cff Of Friedman Llp Ppt Download

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Streamlining Snap For The Gig Economy Digital Benefits Hub

Mortgage Interest Tax Deduction Smartasset Com

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Tax Deductions For Uber Drivers

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube